Harris County MUD 16 (HC MUD 167) wants residents to understand how property taxes are calculated in Texas.

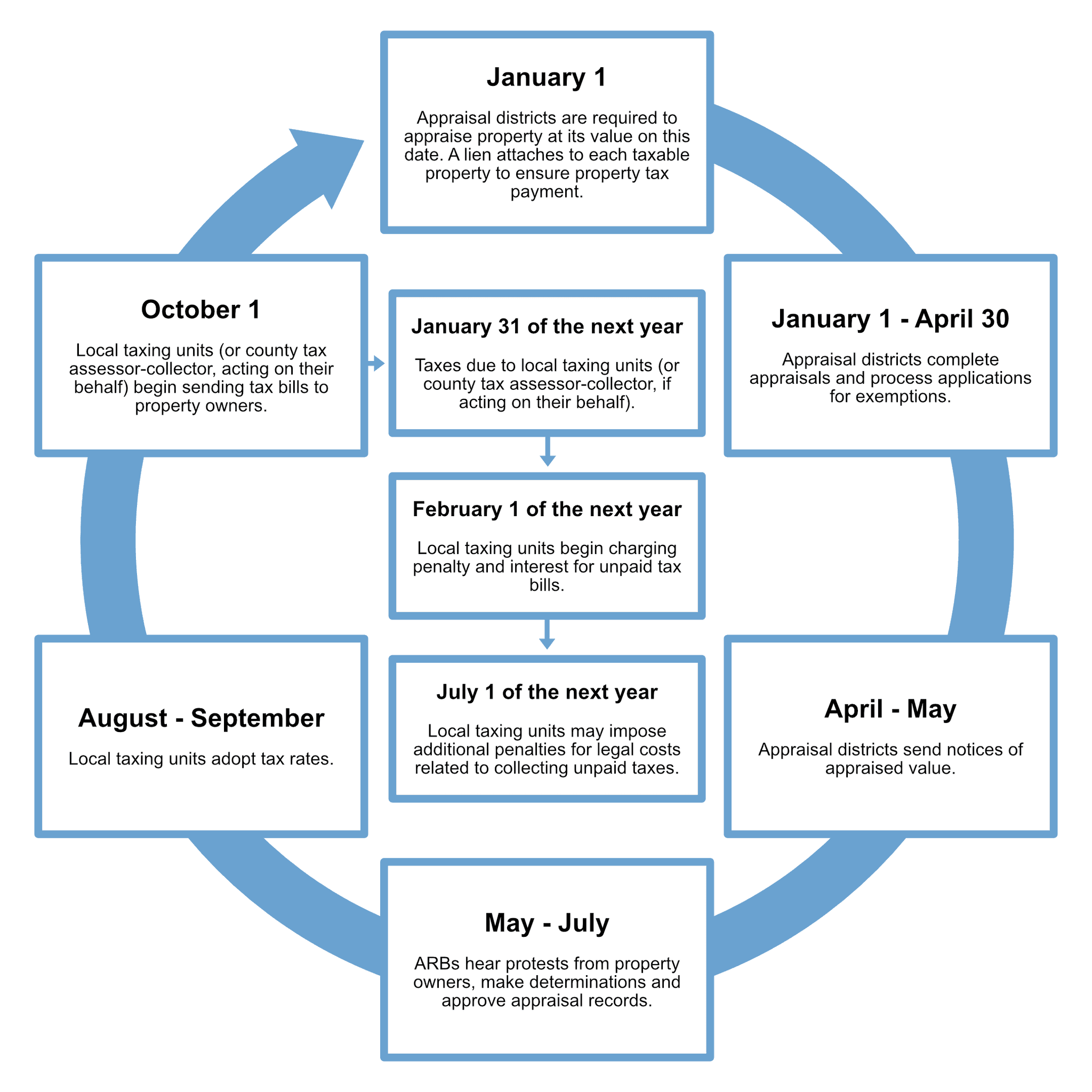

Your property's value is assessed each year on January 1st by the appraisal district and used to calculate your tax bill. Once the values are certified by the county appraisal district, the Board of Directors sets the tax rate for Harris County MUD 167 based on input from their financial consultants. Your tax bill is calculated by multiplying your property’s appraised value by the tax rate.

Remember:

- Your property's value is assessed every January 1st.

- Local entities set their own tax rates.

- You have until the end of January to pay your property tax bill without penalty.

Watch this informational video produced by the Association of Water Board Directors to learn more.